It only takes one email to start your business in Japan

A specialized accounting firm focused on providing tax and accounting services to foreign-affiliated companies.

ECOVIS AKIA Tax Consultants is a specialized accounting firm established in 2008 in Kannai, Yokohama, dedicated to serving foreign-affiliated companies in Japan.

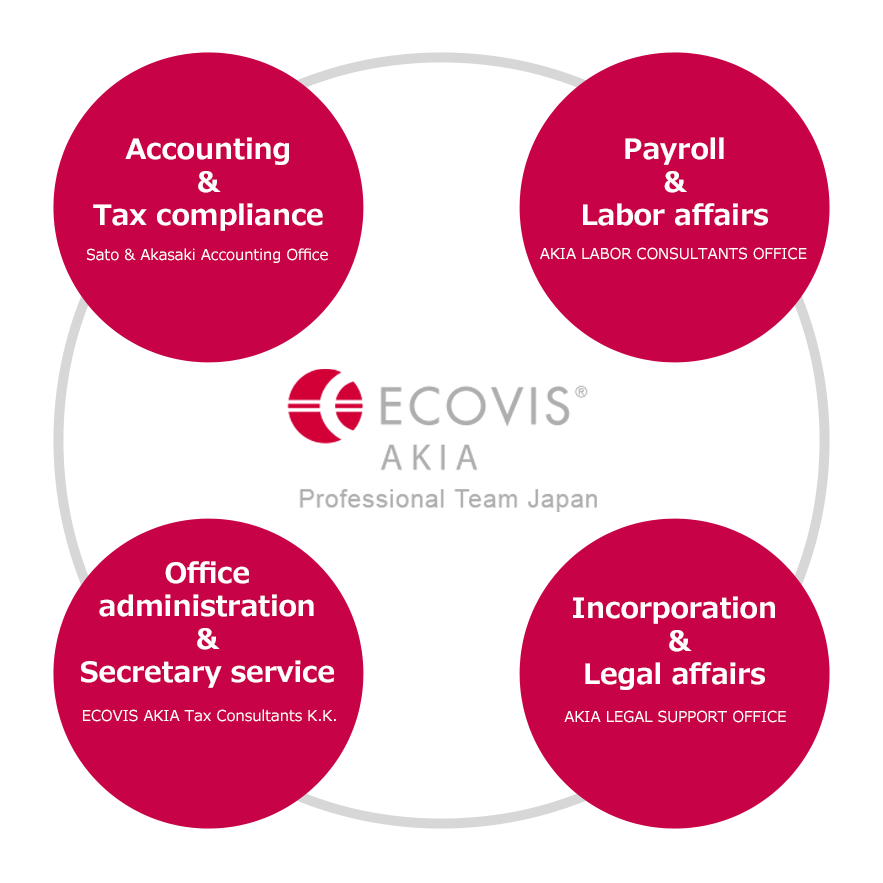

With a group structure that includes a certified tax accountant office, a certified social insurance and labor consultant office, and a certified administrative scrivener office, we provide comprehensive one-stop services to support the operations of foreign companies in Japan.

Our services include tax compliance and filings, accounting, payroll processing, social insurance procedures, payment agency services, company incorporation, visa applications, and other legal affairs.

Even in the midst of an increasingly complex environment marked by frequent legal reforms in response to diversified business activities, we deliver personalized domestic and international tax services backed by extensive experience and strong information-gathering capabilities.

We are committed to providing comprehensive support so that foreign-affiliated companies entering the Japanese market can focus on their business with peace of mind.

Behind one email are many specialists

CONTACT

Business Hour 9:00~18:00 Closed on Saturday, Sunday and National Holidays